La conférence aura lieu le 9 octobre 2017 dans le cadre de la Semaine Africaine de la Microfinance à Addis Abeba en Ethiopie

Research Meets Africa a pour but de valoriser la recherche et l’innovation dans le domaine de la finance inclusive en Afrique. Par ailleurs, elle a pour vocation de mettre en relation les chercheurs d’universités africaines et internationales avec les praticiens du secteur de la finance inclusive.

Cette année nous vous invitons à participer à la conférence portant sur la question suivante :

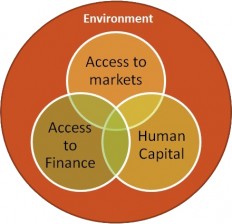

Quelles solutions ou alternatives pour répondre aux besoins de croissance des micro, petites et moyennes entreprises (MPME) en Afrique ?

En effet, dans la plupart des pays du Sud et particulièrement dans les pays les moins avancés, les MPME ont rarement accès au financement bancaire, alors qu’il est fondamental pour leur développement. Ce manque d'accès est identifié comme le chaînon manquant.

Les chercheurs peuvent soumettre un papier présentant leurs travaux de recherche autour des thèmes suivants :

Accès au financement :

- Quels sont les différents services financiers dont une MPME a besoin (emprunts, épargne, services de paiement, Fintech, etc.) ?

- Quel est l’impact des mécanismes de financement alternatifs (innovation sociale, coopératives, mutuelles de solidarité, etc.) ?

- Comment les innovations des Fintech peuvent contribuer au développement des MPME en Afrique (régulation, protection clients, risques, etc.) ?

- Quels sont les différents mécanismes qui peuvent alléger les contraintes de la garantie ?

Capital Humain :

- Quels sont les types de connaissances et de compétences à renforcer ?

- Les institutions de microfinance ont t-elles un rôle à jouer dans l’offre de services pour soutenir le développement des MPME. Si oui, sous quelles conditions ?

- Quelles sont les moyens les plus efficaces pour développer la gestion dans les MPME et améliorer leur capacité de développement ?

Accès aux marchés :

- Quels sont les bénéfices de la formalisation économique en termes d’accès aux marchés ? (régulation, régimes fiscaux, etc.)

- L’exportation et l'accès aux marchés internationaux favorisent-ils la croissance des MPME ?

Programme Research Meets Africa

Lundi 9 octobre 2017, de 9.00 à 17.00

Télécharger ci-dessous le programme détaillé de la conférence Research Meets Africa qui se tiendra le lundi 9 octobre 2017, de 9.00 à 17.00.

Prix Research Meets Africa

Pendant la SAM 2017, Cécile Godfroid a reçu le prix du meilleur papier de recherche présenté durant la conférence Research Meets Africa. Ce prix consiste en une bourse ADA de 1000 euros pour continuer sa recherche et l’invitation à venir à la Semaine Européenne de la Microfinance en novembre 2017 pour présenter son papier, prise en charge par l’Université de Luxembourg. Son papier de recherche s’intitule « Relationship Lending in Microfinance: How does it Impact Client Dropouts? » et porte sur l’importance du maintien de la relation-client de l’institution de microfinance, dans sa stabilité financière et sa performance sociale. Toutes nos félicitations !

Edition précédente (Dakar, Sénégal – 2015)

Terfa W. Abraham est chercheur à l’Institut National d’Etudes Législatives (NILS) à Abuja au Nigéria. Il détient une licence et un master en Economie de l’Université Ahmadu Bello University Zaria du Nigéria et un Ph.D en Sciences Economiques de l’Université Cheikh Anta Diop (UCAD) de Dakar, au Sénégal. Ses recherches se concentrent sur l’économie financière, l’économie du développement, et l’économie lié au changement climatique.

Arcadius Yves Akossou, professeur agrégé en biométrie (Statistiques appliquées) et forestière, Université de Parakou (Bénin)

- Comment s'est passée votre expérience de Research Meets Africa en 2015 ?

La conférence a été une grande expérience très satisfaisante. En effet, la diversité des invités (doctorants, chercheurs, experts européens, internationaux, en particulier les experts et praticiens africains) venant de milieux différents ont permis de suivre au cours de la conférence une variété de thèmes très enrichissants qui ont révélé la situation actuelle du développement du continent, en particulier dans le domaine de l'inclusion financière rurale. La rencontre entre praticiens et chercheurs est donc importante pour l'identification des problèmes prioritaires et des questions de recherche.

Je voudrais encore une fois remercier les organisateurs de la conférence de 2015 ! - Quelle est la valeur ajoutée de la conférence ?

En tant que chercheur et travaillant sur les questions liées au développement, la conférence a été pour moi d'une grande valeur ajoutée dans la mesure où je pouvais rencontrer et interagir avec d'autres chercheurs travaillant sur le même thème que moi, avec des praticiens dans le domaine des finances. En outre, la sélection et la publication de ma présentation dans un document de travail ont donné plus de valeur et plus de visibilité à la recherche que je mène dans ce domaine. - Recommanderiez-vous cette conférence à d'autres chercheurs et praticiens ?

Je vais certainement recommander la conférence à d'autres collègues et à pratiquer des amis qui travaillent sur le terrain. Je pense participer à celui organisé cette année 2017 !

Co-organisateur de la conférence

Innovations for Poverty Action (IPA) découvre et promeut des solutions efficaces contre la pauvreté dans le monde. En partenariat avec les décideurs politiques et les chercheurs, nous concevons, évaluons rigoureusement et améliorons les programmes de développement ainsi que la manière dont ils sont mis en œuvre, nous assurant que les résultats de nos recherches sont utilisés pour améliorer les vies des pauvres. Depuis la création d’IPA en 2002, nous avons travaillé́ avec plus de 575 chercheurs de grande renommée, menant plus de 650 évaluations dans 51 pays. Ces recherches ont informé (nourri) des centaines de programmes performants qui ont aujourd'hui un impact sur des millions de personnes à travers le monde.

Sponsors de la conférence

The MasterCard Foundation collabore avec des organisations visionnaires afin de fournir un plus grand accès à l'éducation, à la formation professionnelle et aux services financiers pour les personnes vivant dans la pauvreté, particulièrement en Afrique. Etant l’une des plus grandes fondations indépendantes, son travail est guidé par sa mission qui est de faire progresser l’éducation et de promouvoir l'inclusion financière afin de créer un monde inclusif et équitable. Basée à Toronto, au Canada, son indépendance a été établie par Mastercard lorsque la Fondation a été créée en 2006.

Pour plus d'information et pour vous inscrire à la newsletter de la Fondation veuillez visiter www.mastercardfdn.org.

Suivez la Fondation @MastercardFdn sur Twitter.

L’Inclusive Finance Network Luxembourg Asbl (InFiNe.lu)  est le réseau national luxembourgeois rassemblant les acteurs clés du secteur public, privé et de la société civile actifs en finance inclusive. InFiNe.lu promeut le droit pour tous à l’accès à des services et produits financiers de qualité et à bas coût. Capitalisant sur la position de leader du Grand-Duché dans les secteurs de la finance et du développement, la mission d'InFiNe.lu est de stimuler davantage l'inclusion financière comme un outil pour la réduction de la pauvreté et l'autonomisation des groupes à faible revenu.

est le réseau national luxembourgeois rassemblant les acteurs clés du secteur public, privé et de la société civile actifs en finance inclusive. InFiNe.lu promeut le droit pour tous à l’accès à des services et produits financiers de qualité et à bas coût. Capitalisant sur la position de leader du Grand-Duché dans les secteurs de la finance et du développement, la mission d'InFiNe.lu est de stimuler davantage l'inclusion financière comme un outil pour la réduction de la pauvreté et l'autonomisation des groupes à faible revenu.

Pour plus d’information, veuillez visiter www.infine.lu.

Le Partenariat Making Finance Work for Africa (MFW4A) a été fondé en 2007 en reconnaissance du fait que le développement du secteur financier en Afrique nécessite la collaboration entre les gouvernements africains, les partenaires au développement, le secteur privé et les autres parties prenantes. C’est une plateforme pour les actions conjointes, la dissémination des idées, et la coordination entre des bailleurs de fonds et les acteurs du secteur financier Africain afin de traiter des priorités dudit secteur. Le Secrétariat de MFW4A, qui est logé à la Banque Africaine de Développement (BAD) à Abidjan, Côte d’Ivoire, a été mis en place en 2008 dans le but de soutenir les activités du Partenariat. Son mandat consiste à (i) centraliser et disséminer les informations et le savoir sur le secteur financier africain ; (ii) rassembler les partenaires et faciliter le dialogue et les échanges sur les thématiques et défis du secteur financier (iii) Assurer l’intermédiation entre l’offre et la demande en termes d’assistance financière afin d’améliorer la coordination et l’efficacité des financements des bailleurs de fonds destinés au secteur financier africain.

a été fondé en 2007 en reconnaissance du fait que le développement du secteur financier en Afrique nécessite la collaboration entre les gouvernements africains, les partenaires au développement, le secteur privé et les autres parties prenantes. C’est une plateforme pour les actions conjointes, la dissémination des idées, et la coordination entre des bailleurs de fonds et les acteurs du secteur financier Africain afin de traiter des priorités dudit secteur. Le Secrétariat de MFW4A, qui est logé à la Banque Africaine de Développement (BAD) à Abidjan, Côte d’Ivoire, a été mis en place en 2008 dans le but de soutenir les activités du Partenariat. Son mandat consiste à (i) centraliser et disséminer les informations et le savoir sur le secteur financier africain ; (ii) rassembler les partenaires et faciliter le dialogue et les échanges sur les thématiques et défis du secteur financier (iii) Assurer l’intermédiation entre l’offre et la demande en termes d’assistance financière afin d’améliorer la coordination et l’efficacité des financements des bailleurs de fonds destinés au secteur financier africain.

Pour plus d’information et pour vous inscrire à notre newsletter veuillez visiter notre site web www.mfw4a.org.

Vous pouvez également nous suivre sur Twitter @mfw4a.