A 10% increase in loans to women allows for an average increase of 8% in children's school attendance and a 5% drop in extreme poverty

Microfinance services provide valuable tools for building a more egalitarian society where women have the means to become self-reliant.

They are microfinance

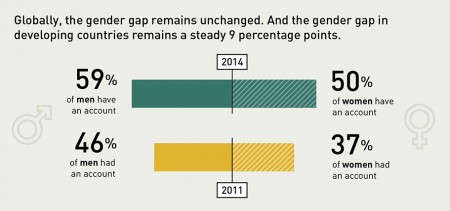

Women are particularly affected by financial exclusion. According to 2014 figures from the World Bank, more than 40% of the world's female population does not have access to formal banking services. Compared to a man, a woman is 20% less likely to own a bank account.

Although financial inclusion has risen sharply in recent years, showing a 13% improvement between 2011 and 2014, the gender gap has remained the same and still stands at 9%.

(Source: Global Findex Database 2014)

Yet studies have shown that women are more likely to spend their financial income on health, nutrition and schooling. Many women turn to microfinance services to get out of poverty. Today, micro-entrepreneurs are mostly women. They represent 73% of microfinance clients according to 2013 figures.

The International Labor Office explains this majority of women among microfinance clients by two factors:

- women are more affected by poverty: 70% of the world's poor are women

- women are more reliable in repaying their credit: the rate of recovery of MFI women clients is 98%

Discover the life stories of entrepreneurs, real heroines of modern times who, thanks to our action in microfinance, were able to create their income-generating activity and get out of poverty.

Four profiles of very different African women who want to change the image of a "female entrepreneur" in their society!

Discover the video-testimonials of four women who, through their work, intelligence and courage, have succeeded in undertaking in cultures where the archetype of the "male" still has a preponderant place. These women come from four different African countries and different professional backgrounds; discover the points of view of these heroines!

"If you undertake and you succeed, you are an example for your children."

Félicité Kambou, Director, Agricultural Service Cooperative Coobsa (COPSA-C), Burkina Faso

How can a woman create a rural cooperative?

"Microfinance can bring both financial and non-financial help."

Josée Mukandinda, Operations Manager, Umutanguha Finance Company, Rwanda

What can a microfinance institution bring to women entrepreneurs?

"I had a lot of difficulty convincing funders and those around me. No one wants to trust us."

Myriam Kadio-Morokro, General Manager, PROCRÉA clinic, Côte d'Ivoire

What difficulties encounter a woman who wants to set up a clinic?

"The woman needs financing and management support so that she can continue her business."

Marèma Bao, Deputy Director, COFINA, Senegal

What are the specific needs of women who want to start an SME?

We had the pleasure of welcoming these four courageous ladies to Luxembourg during the 40th Midi de la Microfinance, entitled "Enabling womEntrepreneurs in Africa". They came to testify about their successes, as well as the difficulties encountered, in front of the Luxembourgish public.

How Isabel escaped from financial exclusion

Isabel Altamirano comes from the mountains of northern Nicaragua, born where the cool breezes blow over the coffee plantations and surrounded by smallholders producing beans, vegetables, sorghum and sugar cane to feed small herds of cattle.

Isabel and her husband were small coffee producers with two hectares to farm. Their very low income was hardly enough to live on and they were continually wondering how to break out of the poverty cycle and overcome their difficulties in surviving from day to day. Many people hoping to earn more money migrate to Costa Rica for work. Isabel’s husband preferred this option.

The first that Isabel heard about obtaining a loan for her coffee plantation was from her friend Marina, who explained that FUNDENUSE, a ‘small bank’, had just opened an agency in the town of Yali in the northwest of the country, not far from where Isabel lived. Isabel remained doubtful but, without consulting her husband, she went to FUNDENUSE to ask them about their services for smallholders. At that time, she was unaware that the visit would change her life.

Isabel thought about how the financial services available from FUNDENUSE could change her life, but didn’t have a clear view of how far they reached. Then came decision day and her husband decided to pick up his backpack and head for Costa Rica, leaving Isabel in charge of the farm and their family, promising to send some money as soon as possible.

Isabel returned to the ‘little bank’. FUNDENUSE offered her a micro-loan to buy better quality seeds to improve the coffee plantation. Isabel received an initial disbursement and took part in a financial education workshop that helped her understand how to use the credit appropriately, the importance of savings and how to record the farm’s income and expenditure.

Following visits from the FUNDENUSE credit agents and some technical training, Isabel started to see a brighter future for her farm. She saw how savings and credit services helped optimize small businesses, set aside liquid reserves in case of a disaster and improve her coffee production. She also discovered ‘environmental productive credit’, which gave her access to advice on how to position bean plants with regard to water flows, use quality seeds and plant trees to protect the soil from erosion, to produce more and for longer.

Some time later, FUNDENUSE launched a new ‘micro-leasing’ service letting small producers use agricultural machinery such as seed drills, tractors, irrigation equipment, and so on, without having to provide a guarantee. This raised much interest from the most innovative farmers in the region.

Isabel also learned about micro-insurance and how to protect herself against life’s ups and downs and make sure that her children would be able to carry on if anything happened to her. FUNDENUSE offers two types of micro-insurance: one to cover accidents at work and another, which appeared more important to Isabel, a type of micro life assurance which would provide financial support to her children in the event of her death. Isabel also took out a pension plan so that she will continue to receive an income when she stops working.

Isabel was busy planning her production and her increased income, made possible by FUNDENUSE products, when she learned that her husband would not be coming home. He had found another woman in Costa Rica and abandoned his family in Nicaragua, not an unusual occurrence among migrants.

However, Isabel did not give up. Her immediate future was busy with her projects and she trusted her ability to make a better life for herself and her children. She didn’t want her marital upset to get in her way and stop her from moving forward. She dreamed of harvesting her beans, acquiring a solar dryer and building a small dam to irrigate vegetables in summer.

On the back of all her hard work, Isabel was rated an AAA client by the FUNDENUSE credit advisers, which means that she is a reliable producer, manages risks carefully and makes regular repayments. Boosted by that reputation and greater self-esteem, Isabel is now a lively, 'go-getting' woman. She has also started to get involved in some of her community’s social causes and is a real example for her peers.

On a busy day like any other, Isabel was so caught up in her work and lost in thought that she didn’t notice the vehicle coming down the track, then doing a U-turn and stopping to offer to take her to its destination. Isabel noticed that most of the passengers on-board were foreign. She was equally surprised to learn that they had actually come to visit her coffee plantation and that they were interested in how she had used FUNDENUSE financial services to break free from poverty. Isabel would never have imagined that she would become a model for success for other women in her region and from across the world!

Article written by Ivan Gutierrez Aguirre, REDCAMIF (translated from French)

These two Tunisian women have succeeded thanks to microcredit!

Taysir, a Tunisian microfinance institution that is also ADA’s partner, offers loans, training and online services that facilitate contact between the MFI and clients and loan repayment.

As a result of Taysir’s services, two female clients of the MFI have been able to start their own businesses. With of a loan of 600 €, Sarra Chrayet opened a business selling windscreens in the outskirts of Tunis. Azm Korkad used her 3000 € loan to set up a nursing home, which she now manages.

Catherine Kurzawa of the Lëtzebuerger Journal tells their stories in the article below (in French only):

20170221 Letzeburger Journal Tunisie 1,010.84 Ko

20170221 Letzeburger Journal Tunisie 1,010.84 Ko

Engracia, baker in Cape Verde, describes her experience in micro-entrepreneurship

"My name's Engracia and I live in Tira Chapéu, one of the municipalities of Praia, the capital of Cape Verde."

I live with my husband José and our five children. We set up a small bakery on the first floor of our home. We make bolachas, a sort of cookie typical of our area.

Difficult beginnings

At the beginning we had just one oven and no staff to help us. José was exhausted because he had to bake the biscuits and then sell them in town. He went there by bus and on foot. We didn't earn much money and we always had to wait until we had sold all our biscuits before we could buy the ingredients for a new batch. It was difficult.

Then, one day, a friend of José's told us he'd been able to expand his small factory thanks to a microloan. We decided to give it a go. An agent from the Solmi microfinance institution came to see our bakery and we got our first microloan. We used the money to buy a second oven and a stock of flour, and we started to make more biscuits.

Microcredits to grow

We've since taken out a few microloans that we used to expand our workshop, replace our old equipment and buy a van to deliver cookies in town. We've grown so much that we even hired a few apprentices. Now, eight young people work in our workshop. In the beginning we went through a 200 kg sack of flour every week. Now we use one every day! Because we now buy more ingredients at the same time, we pay less for them. Our supplier gives us a discount if we buy 10 sacks of flour in one go.

The microloan really improved our lives. We've been able to send our children to school and José is less tired now thanks to his van and the employees who work with us. José also took a course in small enterprise management at the microfinance institution. He is now very skilled at managing our bakery. We feel stronger and freer.

Over the next few years we'd like to make our biscuits even better by purchasing higher quality products. We'd also like to expand the workshop a bit and get newer equipment, as we still use wood ovens for baking. We'd also like to sell our produce farther from here, outside the capital and, why not, beyond the island of Santiago.

Isabel Trujillo, innkeeper in Peru

"My name's Isabel and I live in Coporaque, a small village sitting at a height of 3,575 metres in the Colca Canyon. In 2009, I outfitted two big rooms in my house to create a small inn I christened "Casa del Inka". I rent out the rooms to tourists travelling through the region. I live with my husband and our three children, who are 16, 13, and 11 years old.

When the rooms are not occupied, I leave with my husband in the morning to work in our corn, bean, and pea fields. We also own a small herd of cattle and sheep. If we've got tourists at the inn, I stay to make them breakfast and take them on a tour of the village. Sometimes, I teach them to cook local dishes. I do my best to make sure they enjoy their stay.

Here, the nights are cold, and tourists like to have hot showers. I used to have an electric water heater that broke down all the time and consumed lots of electricity. It made me angry when there wasn't any hot water for the tourists to have showers.

One day, I heard on the radio that the microfinance institution Fondesurco was offering microloans for purchasing solar water heaters. This piqued our interest, and my husband and I asked the institution for further information. We decided to apply for this microloan, which enabled us to buy a solar water heater. We repaid it after one year in monthly instalments. The installments weren't too high, so we didn't have any trouble paying it back.

Now, I'm certain of having hot water for tourists at all times, and I don't have to worry about the electric system. Thanks to this new service, I was able to raise my rates. I also use hot water for household chores. My husband is delighted at being able to have a hot bath when he gets home from the fields. I also wash clothes with hot water now. It's much more effective.

My electricity bills have come down a lot since I got the solar water heater. Moreover, it doesn't harm the environment or pollute. Protecting nature and our children's health is important. Tourists also like the fact that it's a green system; in fact, some of them come to my inn for this sole reason.

I use the money I make by renting out the rooms to pay for my children's tuition. I'm even thinking of sending my eldest child to university.

At the beginning, I didn't use hot water because I wasn't used to it. The water heater boiled over and this got me worried. I called the institution and they sent a technician round. He told me that it wasn't a big deal if the water heater boiled over, but also that I should have no qualms about using hot water myself. So, I started to use it for household chores; and now, I couldn't go without it!

I'd like to buy a low energy consumption oven for my kitchen sometime in the future. There's also a microloan for purchasing this type of oven. I'd also like to have solar lamps for the evening. Tourists like to have some light when it gets dark. I'd also like to make the inn bigger and add a few rooms. Microloans help me to improve my inn little by little while protecting the environment and our health. I'm very happy I came across microloans and solar power, and delighted that my family is reaping the benefits."