Agricultural and forestry value chains

Tailored financial products for smallholder farmers and small-scale forest owners

ADA strives to improve the livelihoods of smallholder farmers and small-scale forest owners through increased resilience as well as facilitated access to markets and appropriate financial services. To this end, ADA connects value chain actors and provides technical assistance to promote sustainable agricultural and forestry practices.

While crop yields are expected to decline in the coming years due to deteriorating climatic conditions and land degradation, the agricultural sector is also a major contributor to climate change due to unsustainable management of land (monoculture, use of chemical fertilisers and pesticides), forests (deforestation) and livestock (overgrazing). Nevertheless, the agricultural and forestry sectors are crucial for the livelihood of smallholders, food security and environmental protection.

To increase the productivity and resilience of the sector, farmers, forest owners and other actors in agricultural, agri-food and forestry value chains in developing countries need access to appropriate financial services.

However, many microfinance institutions (MFIs) lack the resources and tools for managing agricultural and forestry loans but also shy away from the operational costs and perceived high risks, making it difficult for farmers and forest owners to obtain financing to improve their production practices and access new markets. Limited structured value chains for staple crops is often another reason for limited funding by financial institutions.

To overcome these challenges, ADA’s support for small-scale producers is threefold:

— ADA puts in place technical assistance projects that help producers to increase productivity and sustainability through best practices.

— ADA strives to develop agricultural and forestry financing services with MFIs, mainly to facilitate farmers’ and forest owners’ access to financing.

— ADA strengthens the links between different value chain actors to facilitate market access for farmers, forest owners and processors so that they can sell their products at a fair price.

Strengthening value chains to improve market access for small producers

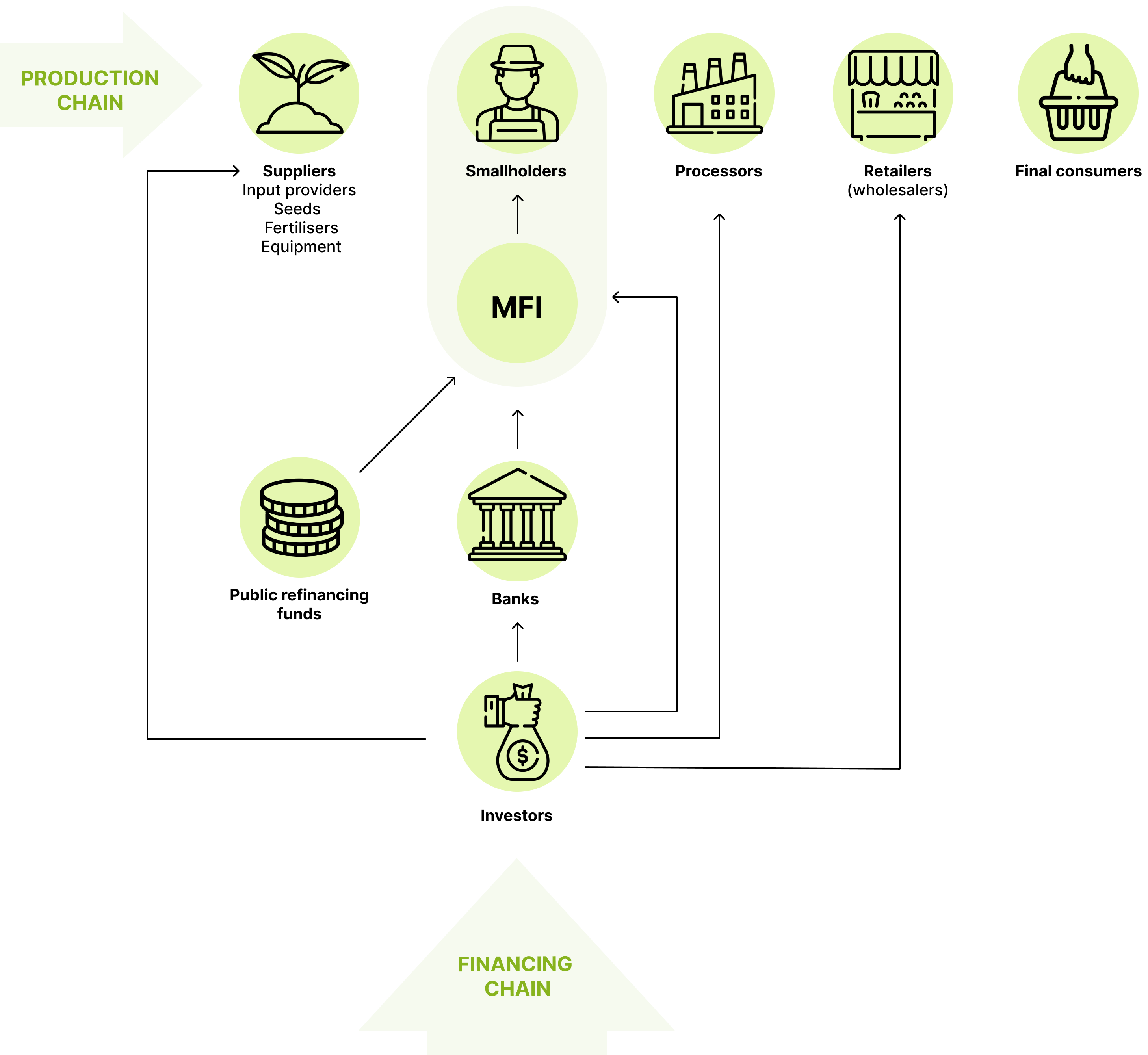

In order to address structural weaknesses, ADA favours an approach that focuses on integrating smallholders into the value chains of both the agricultural and forestry sectors. Upstream of production, the emphasis is on ensuring that smallholders have access to the resources they need, such as quality seeds and inputs and efficient tools and equipment, to increase the productivity of their activities. Support to encourage the adoption of good production practices also helps to improve the quality and viability of their activities. Similarly, downstream, ADA focuses on the needs of buyers (wholesalers) and end consumers to ensure more efficient access to markets for products.

The value chain approach favoured by ADA thus aims to strengthen collaboration and relationships between all the players involved in the agricultural and forestry production chain: this includes suppliers of inputs, such as seeds, fertilisers and equipment; small-scale farmers and foresters/producers; organisations specialising in building innovative technical skills, particularly for climate-smart agricultural practices and sustainable forest management; processors who convert raw materials into finished products; buyers (wholesalers) and end consumers.

As well as strengthening the production chain, the approach aims to consolidate the financing chain by involving all the financial institutions capable of providing appropriate financing solutions, not only to smallholders, but also to input/plant suppliers, processors and wholesalers.

In this context, ADA set up several innovative pilot projects in 2022 to connect suppliers and buyers and to complement financial services with digital and capacity-building solutions.

The tested solutions include entrepreneurial capacity building programmes for SMEs, agricultural index insurance, training in adequate practices and a marketing platform for agricultural products.

Taking into account the specific needs of small-scale foresters

In addition, ADA is setting up a fully-fledged multiannual programme for strengthening forestry value chains. Under this programme, ADA aims to connect different actors and to provide tailored financing and training to different types of forestry professionals such as forest owners and micro to medium-sized wood-processing businesses.

SSNUP: an international smallholder farmer support programme coordinated by ADA

SSNUP (Smallholder Safety Net Upscaling Programme) aims at increasing the productivity and resilience of smallholder farmers in Africa, Latin America and Asia. SSNUP co-finances technical assistance projects designed and set up by impact investors to support smallholder farmers and value chain actors such as SMEs, agricultural cooperatives, MFIs and other agricultural financial intermediaries. These projects can range from developing index insurance to promoting climate-smart and agroecological farming.

In addition to the expected positive effects on the resilience and productivity of small-scale farmers, the medium-term aim of strengthening other players in the value chains via these projects is to stimulate private investment in these countries’ agricultural sectors, thereby promoting their sustainable development.

F2.0: an online platform to give smallholder farmers and cooperatives easier access to financing

ADA’s F2.0 online platform connects smallholder farmers and cooperatives with MFIs to give them access to tailored and efficient agricultural financing. In addition, streamlined input and stock management increases the profitability of the cooperatives, strengthens income security for farmers and reduces risk for the MFIs.

Smart agriculture: promoting the use of climate-resilient farming techniques

ADA encourages vulnerable smallholders to adopt environmentally friendly practices. Together with its MFI partners, ADA designs green loans to promote sustainable agriculture and provides their farmer clients with the necessary training.

ICFI: unlocking climate finance for vulnerable populations

ADA's Inclusive Climate Finance Initiative (ICFI) strives to channel international climate finance to the people who need it most. To this end, the programme will aim to both increase the supply of financing on the one hand and to facilitate the adaptation of vulnerable populations to climate change on the other hand. ICFI is being implemented through regional projects in Asia and Fiji as well as in Central America and the Dominican Republic with international and local partners.

Key figures 2024

156,030

beneficiaries of solutions to help small agricultural and forestry producers better manage their farming activities

19,019

beneficiaries of loans for agricultural production

79,833

producers provided with financial training

97,803

producers trained in good agricultural practices

2,311

beneficiaries trained in good forestry practices

16,820

producers certified (fair trade, organic, etc.)

244

supported partner organisations (187 via the SSNUP programme)

Contribution to the SDGs

2.3 — Increase the agricultural productivity and income of small-scale food producers, including access to financial services

2.4 — Adoption of productive, sustainable and resilient agricultural practices

8.3 — Develop the economy, support the creation of decent jobs and promote entrepreneurship

8.10 — Strengthen the capacity of domestic financial institutions

15.2 — Sustainable forest management

IN A NUTSHELL

ADA supports smallholders by connecting them with other actors in the agricultural and forestry value chains, by providing financial education and facilitating their access to tailored finance, as well as by encouraging sustainable, climate-smart agricultural practices.

LATEST NEWS

26 June 2025

Securing harvests against drought: the role of index insurance

As part of ADA’s Farmer 2.0 (F2.0) programme, Compagnie Nationale d'Assurance Agricole du Sénégal (CNAAS) and the insurtech IBISA are collaborating to provide a rainfall-based insurance product for smallholder farmers.

26 May 2025

How can we improve access to finance and markets for smallholder farmers in Senegal?

ADA has launched the Farmer 2.0 (F2.0) programme in Senegal. This innovative initiative combines digital tools and on-site support.

08 May 2025

Launch of the climate-resilient agriculture programme: concrete action from 2025 onwards

ADA is launching its new climate-resilient agriculture programme in West Africa - mainly in Benin and Togo.

09 July 2024

The MFI Assilassimé in Togo supports the ecological transition of smallholder farmers

In 2017, ADA and FAO launched a capacity-building program for financial institutions in Francophone Africa, aimed at improving their services to smallholder farmers.

13 November 2023

Completed SSNUP project gives farmers in West Africa access to crop index insurance

To facilitate smallholders’ access to insurance, the microinsurance broker Inclusive Guarantee initiated a project with the support of SSNUP and Oikocredit in 2021 with the aim of developing and distributing crop index insurance in West Africa.

04 September 2023

Strengthening smallholder resilience through agroecology

As the SSNUP knowledge manager and coordinator, ADA recently organised a workshop for programme stakeholders with experts in agroecology on how to foster agroecological transitions.

30 August 2023

Green loans for farmers in Costa Rica and Nicaragua

ADA encourages vulnerable smallholders to adopt environmentally friendly practices. Together with REDCAMIF, the regional microfinance network in Central America and the Caribbean, ADA assisted two Costa Rican and Nicaraguan MFIs in developing green loans