Digital strategy workshop for ACEP

July 2019

Following two weeks of digital training at the Boulder Institute, the subsidiaries of the ACEP group sought to organise their own workshop on digital strategy. ADA and the consulting firm Amarante are supporting the ACEP group during the establishment of this strategy. This decision, which was initiated in the summer of 2018, is coming to fruition and the group is at the decision-making stage before implementation.

By bringing together the directors and the operational staff from each country, a common strategy was established which gives the subsidiaries the freedom to choose their own agendas and priorities.

The ACEP network, established in 4 countries (Cameroon, Burkina Faso, Niger and Madagascar ) is one of the main microfinance actors in Africa.

March 2019

LAPO Sierra Leone at ADA for the Digital Finance Initiative

The microfinance institution LAPO in Freewtown, Sierra Leone, was on a trip to ADA to work with Arnaud de Lavalette, Senior Digital Project Manager, on a digital finance project to improve their information and management system. LAPO also received USD 360K in funding this year from ADA through the LMDF investment fund.

Watch the video testimonies of Gabriel ESHIAGUE, CEO, and Emmanuel ROBINSON, Head of IT.

February 2019

Digital Finance Workshop for two MFIs in Kigali

Two microfinance institutions, COOPEC CAHI of DRC and Umutanguha Finance Company (UFC) of Rwanda, participated in a "Digital Finance" workshop led by ADA in Kigali (Rwanda) from 11 to 15 February 2019. The participants were able to define the strategy. of their institution and draw up a plan of action to achieve it.

November 2018

Digital Finance Initiative and support of COOPEC-SIFA

Philippe FORI, director of COOPEC-SIFA, and the management committee participated in a "Digital Finance" workshop led by ADA in Dapaong (Togo), the city where the head office of this microfinance institution is located. The objectives of this workshop were to define the digital strategy that COOPEC-SIFA wishes to initiate as early as 2019 and to become familiar with the management tools of this type of project developed by ADA.

July 2018

ADA and the Grameen Crédit Agricole Foundation together for digital training

From the 10 to the 12 of July 2018, following an invitation from the Fondation Grameen Crédit Agricole (FGCA), the DFI (Digital Finance Initiative) team from ADA organised a training course on digital finance in the Ivory Coast.

The training course was delivered to 19 MFI’s invited to the fourth edition of the “African Facility”. The themes of this edition were the agricultural value chain and digital finance. Through these topics, the training aimed to:

- Present the opportunities of digital finance to MFIs

- To encourage MFIs to initiate their digital finance strategy.

Two ADA project managers supervised the training, one for the French-speaking MFIs (Catherine Liziard) and the other for the English-speaking MFIs (Arnaud de Lavalette). All training materials were translated from French into English to meet the needs of the MFIs. These meetings also offered the participants an opportunity to share their ideas and experiences with each other. The exchanges were very useful as not all the MFIs had the same level of knowledge on the subject. This also gave the participants a more active role during the training.

Prior to the training course, the French-speaking MFIs conducted a status review. This approach helped to better understand the state in which the MFI works. At the end of the workshop, they also sent their digital strategy to their supervisor.

This exercise made it possible to identify the MFIs that were ready to carry out a project in digital finance. The English-speaking MFIs presented their digital strategies at the start of the training course to eventually reformulate them at the end.

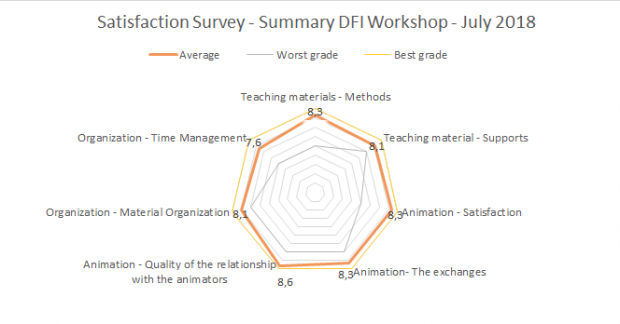

At the end of the course, the MFIs completed an evaluative questionnaire on the training course, the results of which are particularly positive. The most pleasing aspect of the course for the MFIs was the animation, that is to say the relationship between the participants and the coordinators.

Here are the results:

ADA supports two new MFIs in their digital development

June 2018

SIPEM from Madagascar and UFM Louga from Senegal will get their project cofounded.

Following last DFI’s (Digital Finance Initiative) selection committee on Friday 15th, two new MFIs will get their digital projects cofounded.

- SIPEM: The Malagasy MFI will receive 70,000 euros as a support for the acquisition of a digital platform for agents;

- UFM Louga: The co-financing will cover developments and support costs for setting up a new cloud system. The acquisition of computer equipment is excluded from co-financing of 60,000.

DFI’s selection committee brings together the expertise of ADA, LHoFT, LuxFLAG, POST, Deloitte Digital and the Ministry of Foreign and European affairs - Directorate for Development Cooperation and Humanitarian Affairs.

Interview with Adama Camara (Soro Yiriwaso, Mali)

June 2018

Adama Camara, General Manager of Soro Yiriwaso in Mali, talks about his partnership with ADA in digital finance.

Ousmane Thiongane, Director General of U-IMCEC in Senegal, visits ADA

May 2018

Ousmane Thiongane, Director General of U-IMCEC in Senegal, is currently working at ADA in a digital finance workshop. The goal of his visit is to clearly define the digital strategy that could be implemented by U-IMCEC and to become familiar with the project management tools developed by ADA.

Visit of guests of honor with the presence of a delegation from Burkina Faso and the Minister of Finance and Development

May 2018

H. E. Hadizatou Rosine Coulibaly, Minister of Economy, Finance and Development of Burkina Faso, visited the House of Microfinance on Thursday, May 3 to discuss with three of its entities, InFiNe.lu, LMDF and ADA. It was an opportunity for the Minister to recall the importance of partnerships for the development of inclusive finance, especially through digital finance.

Olivier Massart, Executive Director of ADA took the opportunity to present the actions of ADA in Burkina Faso, which will now have one person on site, to work on digital finance in Burkina Faso and the other 11 target countries.

ADA and the Union Financière Mutualiste of Louga join forces on a digital finance project

Feburary 2018

The Union Financière Mutualiste of Louga in Senegal is working with ADA on the definition of a new digital finance project. This project aims to migrate the current management system of the MFI to a cloud solution, allowing customers to withdraw their credits in Wari transaction points, but also to transfer money between them and to repay their loans with agents.Visiting ADA to work with the project manager, Arnaud de Lavalette, Mansour Ndiaye, General Manager of the Union Financière Mutualiste of Louga, tells us more about this project.

Can you tell us more about this digital finance project?

ADA and I are working on a project to digitize a Senegalese-based rural MFI, Union Financière Mutualiste of Louga, which works in the agricultural sector for a largely rural and illiterate population.

We target particular customers, who travel a long distance to deposit money. The solution that we will implement will allow them to withdraw and / or repay a credit in one of the many Wari transaction points disseminated throughout the country, as long as it is granted and made available by our institution. This will prevent the customer from physically traveling to one of our 17 branches, often away from his home, saving time and money.

As representative of MFI, this solution will add value to our products in relation to our customers, while boosting agricultural financing a little more.

The other idea of this project is to move to a cloud system, to allow integration with other interfaces related to money transfers and other transaction systems for the many migrants who reside in the region. This cloud solution should enable us to reach our growth objectives, to grow from 16,000 customers today to 20,000 or 30,000 customers in the coming years.

How did you come to this idea?

We made contact with ADA on the occasion of the African Microfinance Week - SAM - in Addis Ababa last October. Since then, we have been working via videoconference to calibrate the different stages of the project and to send back field information periodically to ADA. I am here today to refine the project, with a view to returning to Senegal with clear ideas and start the second step of the project, namely the implementation of the action plan.

Do you work with other partners on this project?

Not yet, but we can name some partners who have developed with us products like Mastercard or ICCO-TERRAFINA. Together, we have developed 5 new products this year for the agricultural world, particularly on the warrantage, individual loans, value chains ... We are currently looking for financing up to 2.5 million euros for the next 5 years. Our goal is to serve 39,000 producers by 2024.

Arnaud de Lavalette, project manager at ADA, and Mansour Ndiaye, General Manager of the Union Financière Mutualiste of Louga.

ADA launches its first digital finance workshop

April 2017

Following the official launch of its Digital Finance Initiative in October 2016, ADA has received a large number of entries and / or expressions of interest from its Southern partners. Finally, representatives of 9 MFIs (Benin, Mali, Burkina Faso and Senegal) will participate from 3 to 7 April at the first Digital Finance workshop in Cotonou, Benin.

The objective of the workshop is to give participating MFIs the most comprehensive picture of the challenges, opportunities and constraints of new technologies.

Participants will be invited to analyze the main possible scenarios and to evaluate the expected benefits as well as the operational, technological and regulatory impacts. On the basis of this evaluation, each participant will have the opportunity to set priorities and define his / her own model (expected benefits, prerequisites for implementation, governance, deadlines, budgets, etc.).

This workshop is only the first step in a larger project to support MFIs.

Those who wish to do so will be supported in the finalization of specific specifications, in the selection of service providers and in the finalization of an application for co-financing with ADA and possibly other donors.

After acceptance of the file, the implementation phase may start. At this stage, ADA will offer selected MFIs in addition to financial assistance, assistance to project management and deployment support.